Financial Wellness

Resources

Keeping Your Older Loved One Safe from Grandparent Scams

It’s an old stereotype that grandparents will do almost anything for their grandchildren—including opening their wallets more often than they probably should. If they hear their grandchild is experiencing a crisis, their first response is likely to do whatever they can to help them. Unfortunately, fraudsters are taking advantage of this natural impulse to help with a type of scheme known as a “grandparent scam.”

Read More

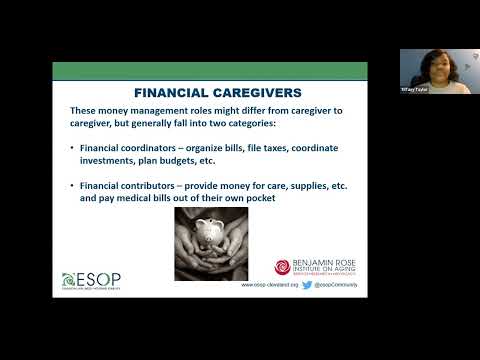

The Financial Fatigue of Caregiving: When Caring for a Loved One with Dementia

This informative webinar is for family and friend caregivers or supporters of persons with dementia. This webinar discusses the effects caregiving has on your finances, and how to effectively manage your finances while balancing multiple responsibilities. We cover how to have difficult conversations about taking on the financial role of caring for a loved one, estate planning and how to make sure your loved ones are protected against financial exploitation.

Watch

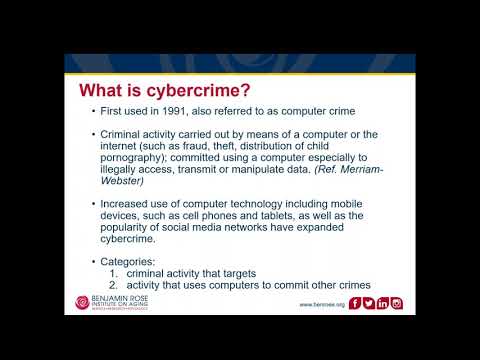

The Impact of Cybercrimes on Mental Health in Older Adults

Cybercrimes have increased 20 percent since the onset of COVID-19 in 2020. Romance scams stole more than $139 million from older adults in 2020. According to a report by the Federal Trade Commission, that’s a 65 percent increase from 2019, when reported losses were nearly $84 million. While the monetary loss is staggering, it is often the devastating emotional toll that impacts the mental health of older adults, their families and those that care for them the most. This webinar will explore the topic of cybercrimes, why older adults are targets, the impact this trauma can have on an individual's mental health and ways to find help in the community.

Watch

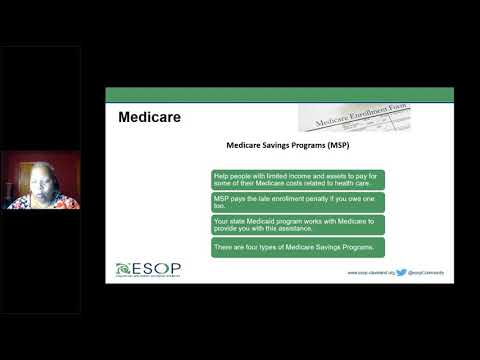

Benefits: You Gave, You Save

Navigating the maze of different benefits and trying to understand what you and your loved one may be eligible for can be a daunting task. Join us for an informative webinar that will outline benefits such as SNAP, Medicaid, Medicare Savings Program and the Low-Income Subsidy. We’ll walk through what the different requirements for these programs are and how to apply.

Watch

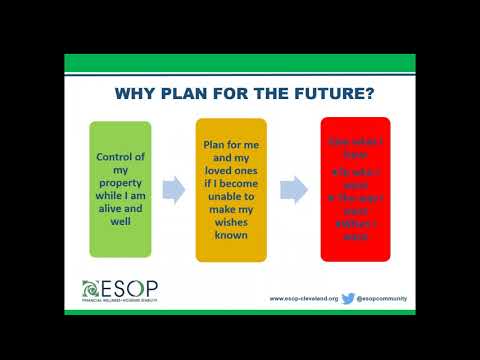

The Caregiver's Guide to Estate Planning: How to Prepare for Yours and Your Loved One's Futures

When was the last time you and your loved one had a discussion about estate planning? If you’re like many people, it’s probably been a while. This webinar will discuss what important financial and medical documents are necessary in case of an emergency, and what to do in those situations. Having these items prepared and organized will not only protect your loved one, but as a caregiver it will give you peace of mind to know that everything is taken care of in advance.

Watch